Tax-advantaged savings plans—such as IRAs, Keogh, 401ks—have a significant tax cost. Understanding their roles and effectiveness in retirement funding is crucial to assessing whether their benefits outweigh their price.

Until fairly recently, measuring these accounts’ economic impact was difficult because they are not usually annuitized, but rather taken as irregular cash payments until the mandatory distribution age of 701/2. Current Population Study (CPS) and Health and Retirement Study (HRS) data traditionally haven’t included irregular payments as measured retirement income, although they certainly contribute to beneficiaries’ spending and well-being. Some researchers believe that the difficulty in capturing irregular withdrawals has probably led to under-reporting of them in the CPS/HRS, and in turn, an underestimation of retirees’ wealth.

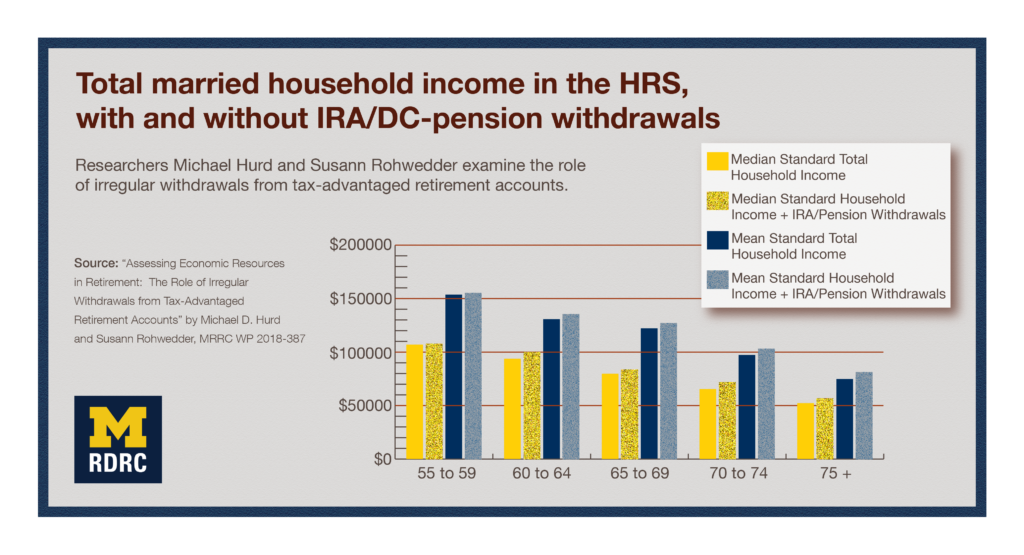

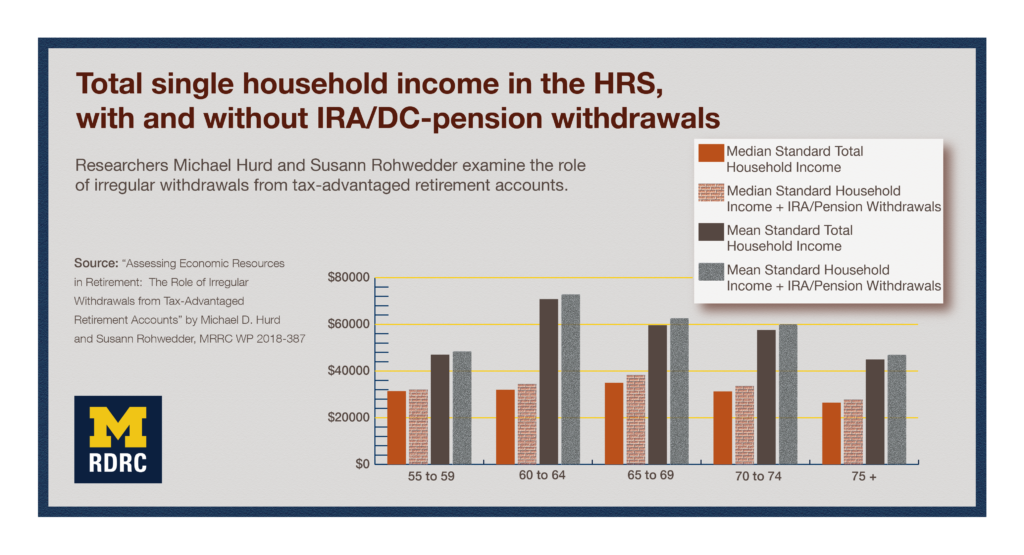

In 2012 and 2014, HRS changed its survey questions regarding pensions in order to better account for irregular income. Michael D. Hurd and Susann Rohwedder’s 2018 study, “Assessing Economic Resources in Retirement: The Role of Irregular Withdrawals from Tax-Advantaged Retirement Accounts,” used the 2014 revised HRS survey to track irregular pension/IRA withdrawals. They found:

- “Irregular withdrawals from pensions and IRAs amount to $2,049 for singles and $6,663 for couples on average among those age 55 and older, but they are zero at the median.

- “Among those making withdrawals, the average amount is $17,000 for pension withdrawals and $10,400 for IRA withdrawals.

- “Compared to total household income, irregular IRA and pension withdrawals amount to about 5% of income for singles and 10% of income for married households.

- “The irregular withdrawals are concentrated among those in the highest wealth quartile and those in the highest education group, reflecting the higher prevalence of pensions in high-paying jobs predominantly held by those with high education. Thus, they have little impact on poverty rates.”

In a related project, the researchers built new variables for the RAND HRS, allowing other researchers to easily access IRA/pension information. Details on Hurd and Rohwedder’s methods and the evolution of the HRS’ pension survey questions are available in the working paper, WP 2018-387.