If Michael Hurd, Erik Meijer, Philip Pantoja, and Susann Rohwedder’s “Addition to the RAND HRS Longitudinal Files: IRA Withdrawals in the HRS, 2000-2014” were a home improvement project, the researchers would have put up spacious bookshelves in the Health and Retirement Study (HRS) library to support future research on how tax-advantaged savings might affect retirement preparedness.

Hurd et al. captured IRA withdrawals with new variables to the RAND Health and Retirement Study (HRS). Such withdrawals have traditionally not been counted as income in HRS data, but there’s no doubt that they help fund retirement spending. Without their inclusion, an assessment of retirement wealth is incomplete.

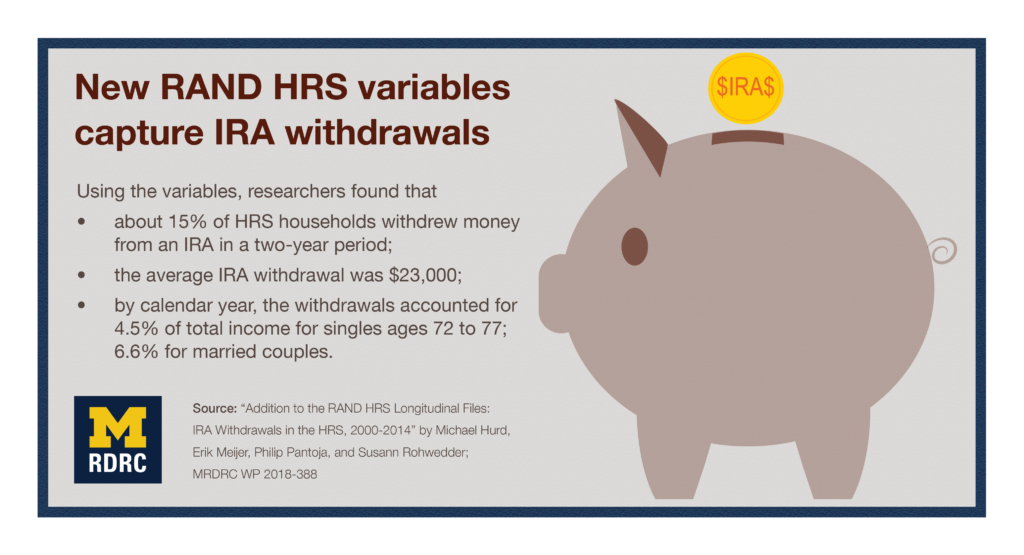

Using the new variables, the researchers found that

- about 15% of HRS households withdrew money from an IRA in a two-year period;

- the average IRA withdrawal was $23,000;

- by calendar year, the withdrawals accounted for 4.5% of total income for singles ages 72 to 77; 6.6% for married couples.

These findings—and ones from subsequent work using the IRA variables—will give researchers and policymakers a more accurate accounting of wealth, who holds it, and how it’s used in old age. The recently released RAND HRS Longitudinal File 2016 includes the full set of IRA variables. For more details on how the researchers derived the new variables, see the MRDRC working paper, WP 2018-388.